Thank you CreditRepair.com for sponsoring this post. CreditRepair.com’s team understands that a credit score is not just a number; it's a lifestyle.

So, 2020 has not exactly been the most ideal year. With so many things happening around us, it might be hard to plan ahead and make important decisions in your life for the future. But you know what? It is the most ideal year to work on your credit score.

Good or bad credit impacts our lives in many more ways than you can imagine. Your credit score can influence the interest rate you receive on a loan or your home mortgage, getting into a new job, your insurance rates, and more. You will be surprised to know how many people are absolutely ignorant of what a credit score is or how a small mistake can wreck their credit score.

My 2020 biggest goal and ultimate resource to building a good credit score

Lately one of my biggest goals for 2020 has been to buy a bigger space for our growing family, so trying to make a good credit score has been my biggest priority this year.

As I was working on this very goal, I looked for resources that could help me build my credit better so that we could buy our dream home as early as possible. One such amazing resource that can be helpful for anyone looking to improve their credit health is CreditRepair.com.

CreditRepair.com Is the most recognized name in credit repair in the United States. They are a team of credit advisors who educate and empower individuals to help them achieve the credit scores they deserve. Read along the post to learn everything there is to know about building good credit and more information about CreditRepair.com.

Pin this post to keep it handy all the time!

All there is to know about building good credit

What is a credit score?

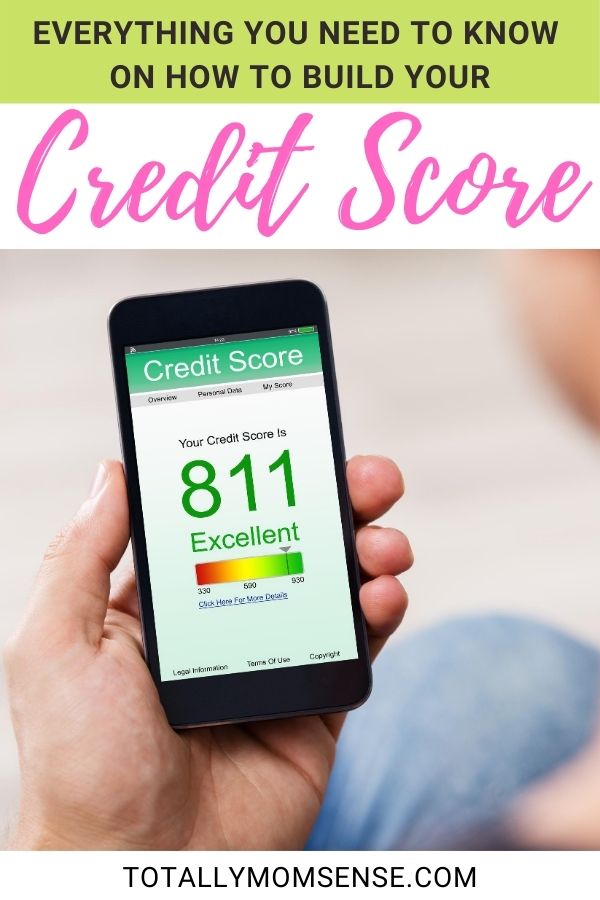

A credit score is a three-digit number that tells lenders about your creditworthiness, which is how likely you are to pay back a loan based on your credit history.

What is a good credit score?

Your lenders will decide whether to lend you the money based on how high you fall in the bracket. Most credit scores are in the 300-850 range. The higher the score, the lower the risk to lenders. A “good” credit score is considered to be in the 680 – 700+ score range, depending on the scoring model used. Your credit score can influence the interest rate you receive on a loan or your home mortgage, finding a rental home, attaining certain jobs, your insurance rates, and more.

What factors can affect your credit score?

- Payment history – Payment history is the most important ingredient in credit scoring, and even one missed payment can have a negative impact on your score. Payment history accounts for 35% of your credit score.

- Length of credit history – How long you've held credit accounts makes up 15% of your credit score. A longer credit history is generally better for your credit score.

- Credit utilization – Generally makes up 30% of your scores. This includes your balances in comparison to your available credit. This makes up your utilization rate and tells lenders if you are using your credit responsibly.

- New credit accounts – The number of credit accounts you've recently applied for account for 10% of your score. (These are known as “hard inquiries.”) “Credit shopping” can indicate increased risk, and as such can hurt your credit score.

- Credit mix – Maintaining a mix of credit (home loan, car loan, credit card, etc.) demonstrates that you can handle multiple types of credit. Along with the other elements above, improving your credit mix can help you reach excellent credit score status. Generally, this accounts for 10% of your credit score.

How can you improve your credit score?

- Try to make more payments toward your existing debt so that you will pay less interest. This will decrease your credit utilization, which, if nothing else changes, should be a positive mark on your credit. It is ideal to always keep your credit card usage below 20% of your limit. I usually set a reminder on my credit cards. As soon as my expenses touch 20%, I get a message on my phone which helps me become more cautious about my future expenditures.

- Do not close old accounts as that will affect your credit age. Having lon-term positive credit is good for your credit profile.

- Beware of hard inquiries when applying or a loan or renting a new home. Too many hard inquiries can hurt your credit and bring it down.

- Make your payments on time so that they don’t get reported. Late payments can really hurt credit history.

How can CreditRepair.com Help you in Improving your Credit?

CreditRepair.com uses a simple three-step process:

- Challenge – CreditRepair.com will check your credit report and challenge inaccurate negative items that are hurting your score.

- Dispute – CreditRepair.com will dispute any negative items by asking creditors to verify the items, and if they can’t, they must stop reporting them.

- Monitor – And most importantly, CreditRepair.com will constantly monitor your credit report for these inaccurate negative items so you can stay on top of your score.

Leave A Comment